This was, by all accounts a tough month for our monthly trades. We kicked the trades off Friday with the market near an all-time high and 4 trading days the following week. Earnings reports started the trading cycle with Goldman Sachs first out of the gate on Monday giving us a head-fake higher, followed by a 12 point decline that brought the whole market down, stopping out several of our plays.

We fought from behind the rest of the week. and ended the week with 2 clear winners AAPL and QQQ, 2 small gainers DIA and GOOG (which missed 100% move due to stop loss), 2 total losers WYNN and BABA, and last we missed a 35% gain in AVGO which brings me back to the stop loss position.

Our monthly trades have never instituted a stop loss, this month we did because of the reasons I gave above about what we were up against this month. I would like your feedback on the stop loss rule, do you think we should use a stop loss, if so what level? Our results would have been 5 nice winner and two losers, versus what we got. Please let us know, our goal is for all of us to make money, that’s what we are here for.

| Date | TypeStrategy | Stock | LenLength | High | CChart |

|---|---|---|---|---|---|

| 04/18/19 | Monthly | AAPL | 5D | 159% | |

| 04/18/19 | Monthly | BABA | 5D | -63% | |

| 04/18/19 | Monthly | DIA | 5D | 21% | |

| 04/18/19 | Monthly | GOOG | 5D | 22% | |

| 04/18/19 | Monthly | QQQ | 5D | 102% | |

| 04/18/19 | Monthly | WYNN | 5D | 12% | |

| 04/18/19 | Monthly | AVGO | 5D | -50% |

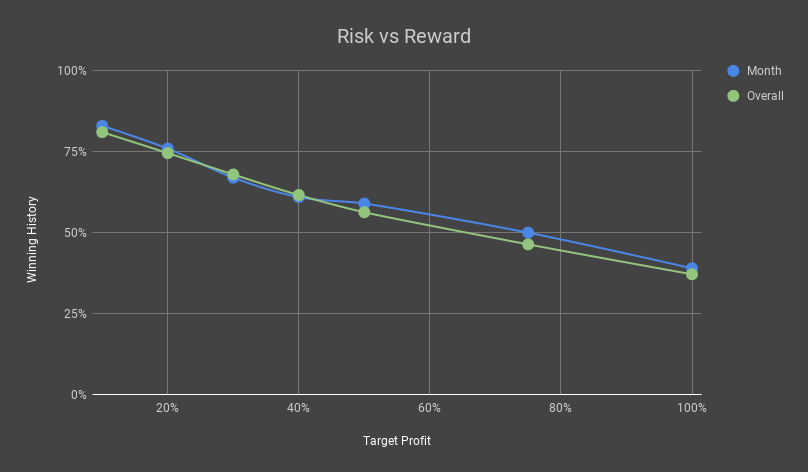

April has consistently been the first taste of truly outstanding trading opportunities for our Monthly Strategy. Our analysis of past data projects a highly optimistic outcome for this year. What is perhaps the most fascinating reveal is how the month outperforms the strategy as a whole for those returns greater than 40%. This indicates that past Aprils have more often produced higher rates of return when the returns reach and exceed our target range. In other words, when April has been a good month in the past, it has been very kind to our members.

As always, we advocate for exits within our target range of 30% - 50% as soon as they are presented. We will update this post after the trade week to recap the performance.

135

Total

trades

117

Winning

trades

87%

Winning

history

102%

Average

return

Returns past 30% outpace the strategy as a whole.

DIA, GOOG, and QQQ are clear winners here. GOOG's average return is outstanding.

| Stock | Plays | Wins | Winning History | Average Return |

|---|---|---|---|---|

| AAPL | 11 | 9 | 81.82% | 95% |

| AMZN | 11 | 8 | 72.73% | 141% |

| BIDU | 7 | 5 | 71.43% | 123% |

| BRCM | 5 | 5 | 100.00% | 150% |

| DIA | 14 | 13 | 92.86% | 92% |

| GOOG | 8 | 8 | 100.00% | 137% |

| IBM | 8 | 7 | 87.50% | 92% |

| QQQ | 14 | 13 | 92.86% | 114% |

| WYNN | 9 | 7 | 77.78% | 60% |

Remember, no matter how great the statistics are or how good past trades were, you must set realistic limit orders to trade this strategy profitably. We highly recommend member's focus on our own target profit goals! As always, make money and happy trading!

78%

81%

20+

Check out our suite of trading websites designed to help generate profit for any type of trader or portfolio.