April kicks the Core Strategy up into far better territory compared to March. All of the key factors are where we expect to see them. The winning history is a full 15 points higher at 85% (better than 8 out of 10 trades) and the average return is a full 12 points higher at 92%. The trade history also looks much better with only 2013 yielding mixed results.

Please note that the market will be closed on Friday, meaning we may trade this Thursday or wait until the following Monday to issue alerts.

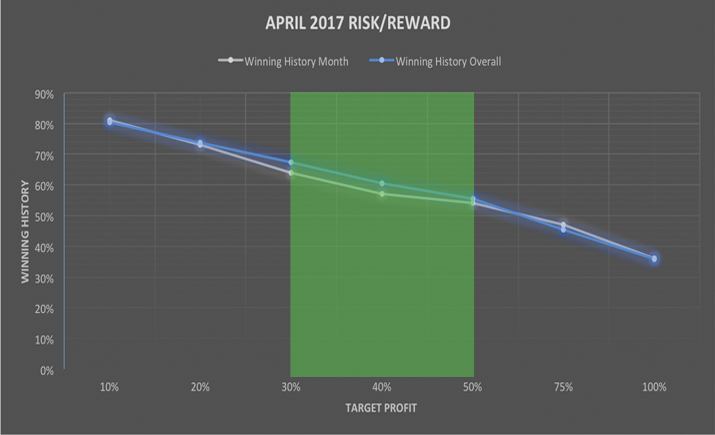

As always, focus on our target guidelines to lock in profits when presented and then drop the trade.