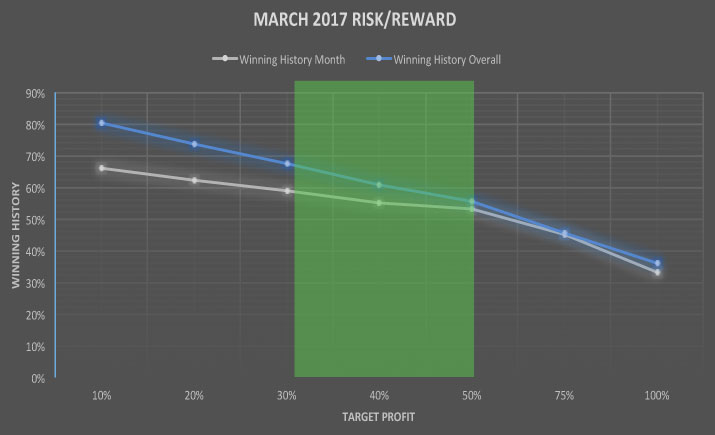

Last month was absolutely stellar for members who traded the Core Strategy. All trades produced outstanding results, easily besting our 30% - 50% target profit range. As we turn our attention to March, thing look a bit grim.

There are no two ways about it, March is the worst performing month based on past trades. That said, we are still looking at a 70% winning history. Isn't it amazing how a 70% winning history seems bad when we are used to 80% or better? To add insult to injury, March boasts one of the lower average returns of just 80% (January is 51%).

If look at the trade history, an interesting story unfolds. March has been unusually polar. We either have all winners or all losers compared to most months which typically have all winners or mostly winners with one or two losing trades.

As always, focus on our target guidelines to lock in profits when presented and then drop the trade.